Introduction

For many tech startups, deducting of R&D expenses has enabled them to invest in experimentation and development without facing severe financial constraints. Section 174 R&D adjustments are causing a lot of discussion among early-stage companies owners and startups, known for pushing boundaries and creating innovative solutions. Is it possible for US tech companies to workaround changes to the IRS Section 174? How can startups balance innovation and fiscal responsibility post-IRS Section 174 amendments? We will uncover these issues and beyond insights in today’s article.

Understanding Section 174: Deciphering the Code

At its core, Section 174 R&D focuses on the tax treatment of Research and Development (R&D) expenditures incurred by businesses. Strategically designed to encourage innovation and R&D investments in new products, software, processes, and technologies, especially it comes up with the IT and tech sectors. Allows deduction expenses, which greatly simplifies the taxation policy for IT tech businesses and startups by reducing their overall tax liability, and this also promotes competitiveness by helping US businesses compete globally by providing tax relief for a crucial driver of economic growth.

What Section 174 IRS allows to deduct (expenses):

- Salaries and wages: directly paid to employees involved in the R&D processes – researchers, scientists, engineers, and more;

- Materials and Supplies: Cost of raw materials, components, and any consumables directly related to the research and development activities;

- Third-party Contractors: Payments made to external entities conducting R&D on behalf of the business, facilitating outsourcing without compromising deductions;

- Testing and Experimentation Expenses: Expenditures tied to the testing and experimentation phase, evaluating the feasibility, functionality, and performance of new products or processes;

- Prototypes or Models: Costs associated with creating and testing prototypes or models before full-scale production.

In general, Section 174 is all about activities that request the development of something new or improvement of existing business stuff. However, not all software development falls under the category of R&D. For instance, routine data collection, debugging, and minor updates may not qualify. On the other hand, creating new algorithms, developing new databases, and building new, more efficient architectures would typically qualify as R&D.

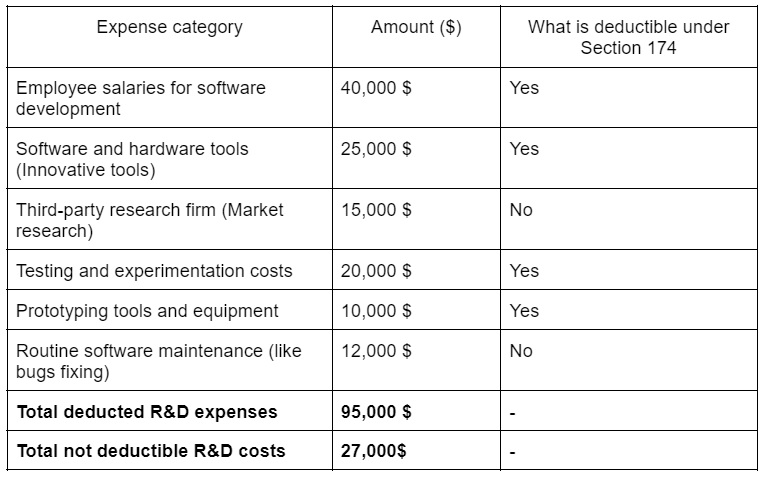

To classify one’s expenses correctly, consider the following guide:

- Innovation focus: Is the expense aimed at creating new products or processes? If yes, it may be classified as R&D.

- Technical Uncertainty: Does the activity involve a significant level of technical uncertainty and problem-solving? If yes, it likely falls under R&D.

- Uncertain Outcomes: Are the outcomes of the activity uncertain at the time of the investment? If so, it’s probably R&D.

These criteria can help differentiate routine software development (squashing bugs, updating minor features, or making sure your app plays nice with the latest phone update, that’s maintenance) from activities that qualify as R&D according to IRS guidelines (is about pushing boundaries, like developing a new algorithm that predicts what users want before they know they want it). It’s necessary to review the specific IRS regulations or consult a tax professional to ensure accurate classification and compliance with tax laws.

Suppose you are developing an innovative component for your business, such as an application. Let’s use a simple example to explain how it works before any changes in method of deducting R&D expenses:

Based on the provided image, we can see the practical impact of changes in the method of deducting the R&D expenses according to Section 174. In this case, our hypothetical company’s revenue of $500,000 could deduct all its eligible R&D expenses, keeping its taxable income and tax due at a neat zero. After new amendments you will only apply $405,000. As a result, the company’s tax liability will be lower. The amount of taxes owed is calculated based on the adjusted taxable income after the Section 174 deduction. This deduction mechanism assists companies in optimizing their tax positions and allocating resources toward crucial research and development initiatives.

However, new amendments to Section 174 R&D radically changed the taxation rules. According to them, your company has to capitalize and amortize the costs over several years: in the US, this period could be as long as five years (for domestic research); or 15 years (for foreign research). New adjustments also prevent deducting R&D costs on sale, liquidation, or abandoning property. Instead, those costs remain capitalized and amortized further. Change in method of R&D expenses amortization applied to that incurred after December 31, 2021. But first things first…

Pre-Amendment Era: Deductible or Capitalized?

In the previous paragraph, we briefly reviewed what the amendment did to the Section 174 R&D regulations. However, the last of the amendments was not the only one that is still being discussed with such indignation. The latest amendments were made in the Tax Cuts and Jobs Act (TCJA) of 2017 and took effect for taxable years beginning after December 31, 2017. After the amendment, taxpayers had two options for R&D expenses:

- Requested immediate deduction from taxable income in the year incurred.

- Capitalization and amortization over five years (domestic R&D) or 15 years (foreign R&D).

Post-Amendment: Mandatory Capitalization and Amortization

However, the latest developments in Section 174 tax amortization in 2022-2023 completely changed the rules of doing business in IT and tech industries, now it is about:

- Mandatory Capitalization: Pre-TCJA, you could choose to deduct R&D expenses directly or capitalize and amortize them. Now, for specified research and experimental (SRE) expenditures, capitalization is mandatory. This means R&D costs are treated as assets, and their value is spread over time through amortization deductions.

- No Amortization Deduction on Sale/Retirement: When R&D property (like patents or prototypes) is sold, retired, or abandoned, the remaining capitalized cost isn’t deductible but continues to be amortized.

- Amortization Periods: The amendments introduce a differentiation in the amortization of onshore and offshore R&D expenses. Domestic (onshore) R&D is subject to a 5-year amortization period, which provides faster tax relief but less incentive to relocate R&D activities. Conversely, foreign (offshore) R&D is subject to a 15-year amortization period, which may be cheaper due to lower labor costs.

What needs to be capitalized?

SRE expenditures under the current Sec.174 definition include:

- Activities that directly request the development or improvement of a company’s products or processes: This includes design, engineering, experimentation, testing, prototyping, pilot projects, and feasibility studies.

- Software development costs: All software development, whether for internal use or marketed products, generally falls under SRE.

- Costs directly associated with SRE activities, like materials, wages, and overhead.

What might not be capitalized?

- Routine or ordinary activities: Quality control, general management, market research, legal/accounting/financing costs, and administrative tasks typically wouldn’t qualify as SRE.

- Activities related to existing products or processes: Routine maintenance, upgrades, or troubleshooting wouldn’t count as SRE.

In this prospect, there have been no changes in method in what should be capitalized and what shouldn’t. While not all R&D tax credit expenses qualify. Expenses such as facilities, depreciation, and foreign labor are not eligible. Now you don’t have to deduct them in the current year of utilizing R&D expenses in your business but depreciate them over the next 5 or 15 years and tax them.

You might also like

business-intelligence

TOP ML Development Companies on Upwork in 2024

Upwork is an online marketplace that connects freelancers and agencies with businesses needing skilled professionals for various projects. Upwork provides a platform for a broad range of services from writing and graphic design to programming and digital marketing. It has become a go-to source for over five million businesses (including development companies) to hire freelancers […]

Who does Section 174 apply to? Industries affected and Exemptions

Section 174 R&D expenses of the Internal Revenue Code (IRS) applies to taxpayers who incur qualified research or experimental (SRE) expenditures in connection with their businesses. This includes:

- individuals, such as self-employed individuals, entrepreneurs, and independent contractors, who can claim Section 174 deductions for their own R&D activities, as well as businesses.

All businesses, regardless of size, can benefit from Section 174 deduction if they engage in qualified research and development. This includes:

- Technology and software industries;

- Pharmaceuticals and biotechnology;

- Manufacturing and engineering;

- Aerospace and defense industries;

- Automotive manufacturers.

While Section 174 applies to all taxpayers dealing with research and development (R&D) expenses, its implications are more evident for certain groups and industries, that include:

- Businesses with substantial R&D investments are likely to suffer the most;

- Equally, startups and early-stage companies are also at risk, as the initial phase of R&D expenditure is critical for them. This can hinder cash flows and limit their ability to invest further.

- Industries characterized by short development cycles face special problems under Article 174. The tax burden, exacerbated by the capitalization and amortization of R&D expenditures, places a heavy burden on sectors experiencing rapid product improvement.

Section 174 R&D is forcing a close examination of the balance between innovation and fiscal responsibility as it shapes the financial trajectories of these sectors. Some organizations may have restrictions or special rules regarding Section 174. Pass-through entities, such as S-corporations, partnerships, and limited liability companies (LLCs), can claim Section 174 deductions, but they are reported on the individual owners’ tax returns. Tax-exempt organizations, such as non-profit organizations and government agencies, do not pay income tax and therefore do not benefit from Section 174 allocations. However, there are some exceptions for research conducted on behalf of the government.

Navigating Amortization under new rules

Under the current rules (after the TCJA), the depreciation of expenses in Section 174 requires different procedures depending on when the expenses were incurred and the specific type of expenses. For expenses incurred after 31 December 2021, you can use the following criteria:

- Identify qualified SRE expenses: Ensure your R&D expenses qualify for Section 174 by consulting the IRS SRE determination guidelines and verifying that your expenses meet the criteria.

- Next, determine the depreciation period. Domestic SREs typically depreciate over 5 years, while foreign SREs depreciate over 15 years.

- Finally, calculate the depreciable base. This is the total amount of eligible expenses incurred during the year.

- Select the depreciation method. The most common methods are the straight-line method and the half-year method.

- Depreciation should begin from the middle of the tax year in which the expenses were incurred. This means that you will calculate depreciation for half a year in the first year and for a full year in subsequent years.

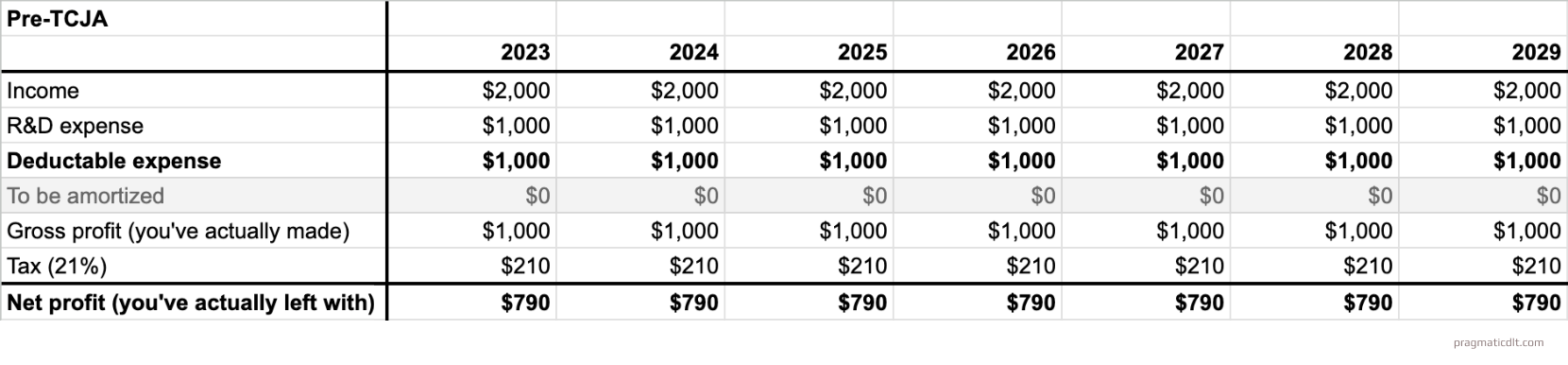

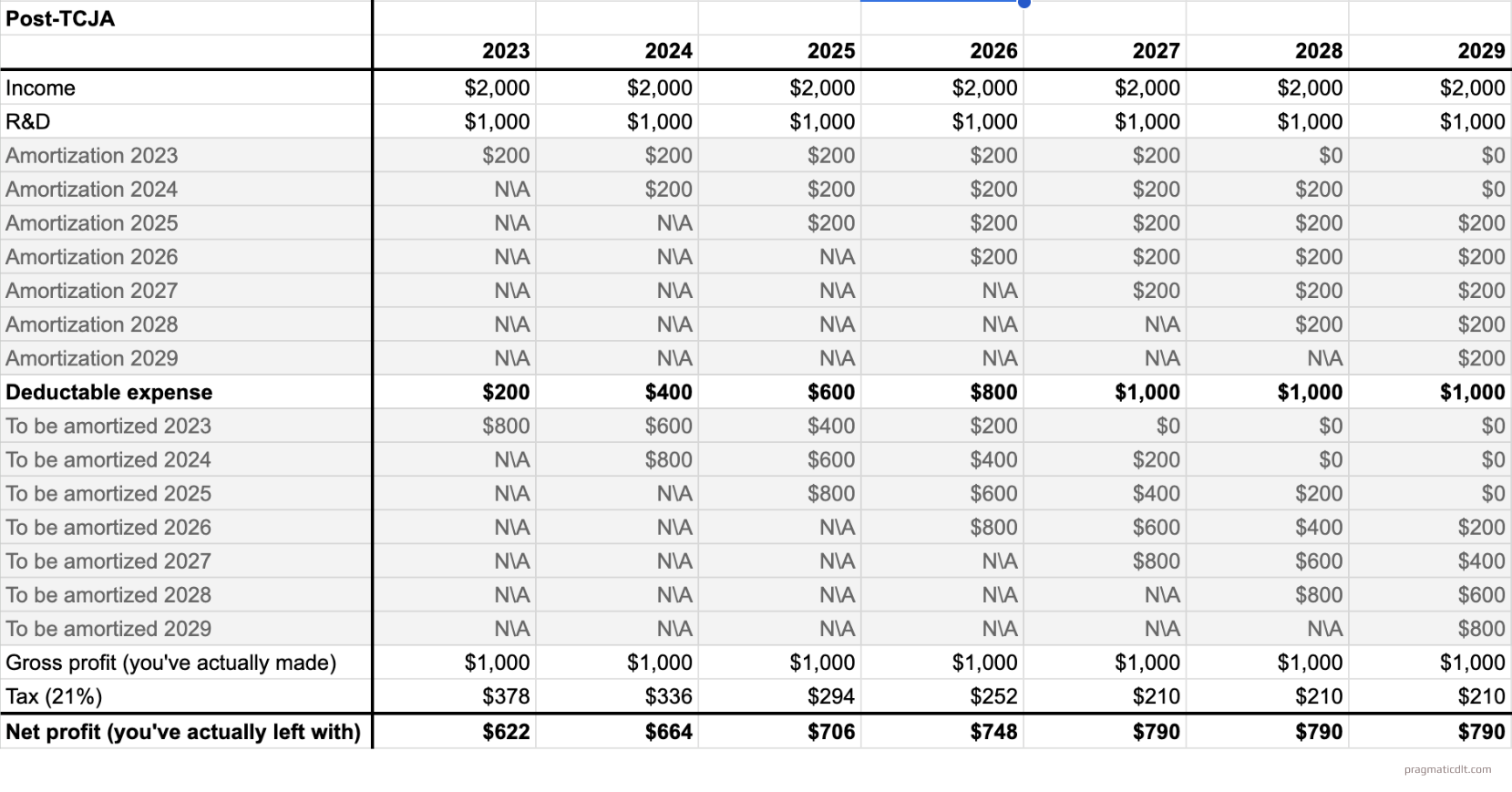

To illustrate the impact of the pre-TCJA deduction vs. post-TCJA capitalization of R&D expenses, let’s take the example of one SAAS startup company ACME.com, which makes $2 million in annual revenue and $1 million in software development expenses a year. ACME decided to develop a new sub-product, and the majority of its software development expenses are now classified as R&D. So that’s how their expenses will look in relation to the latest amends of Section 174:

Pre-TCJA Deduction

Post-TCJA Deduction

The amortizable base (total eligible SRE expenditures) is divided equally over the prescribed amortization period (5 or 15 years), resulting in the same annual amortization deduction for each year. As we can see here, though the total tax over the years remains the same, startups face higher taxes early when they’re most at risk, increasing their financial burden and reducing incentives to innovate.

Software R&D is not like the others.

Depreciation applies to tangible assets, such as equipment or buildings, that wear out over time. The cost of these assets is recovered through depreciation charges over their useful lives. Section 174 expenses apply to intangible assets, such as software development or patents, that arise from research and development activities. You can recoup the cost by spreading it out over a specific period of time through amortization charges. The Consolidated Appropriations Act of 2024 allows for the partial retroactive deductibility of certain Electronic Manufacturing Services (EMS) costs, starting with tax year 2022.

And you got it right, you only need to start amortizing R&D costs under the new rules for expenses incurred on or after January 1, 2022. Expenses incurred before December 31, 2021, can still be deducted under the pre-TCJA rules. For tax years before 2022, you can deduct or capitalize the expenses. In tax year 2022, you can treat R&D expenses incurred in the first six months under pre-TCJA rules, allowing for deduction or capitalization. The new rules require mandatory capitalization and amortization for expenses incurred in the last six months and beyond. From tax year 2023 onwards, all SRE expenditures within the year must follow these rules based on the appropriate period.

How to workaround Section 174? / Strategic Workarounds for Section 174 Changes

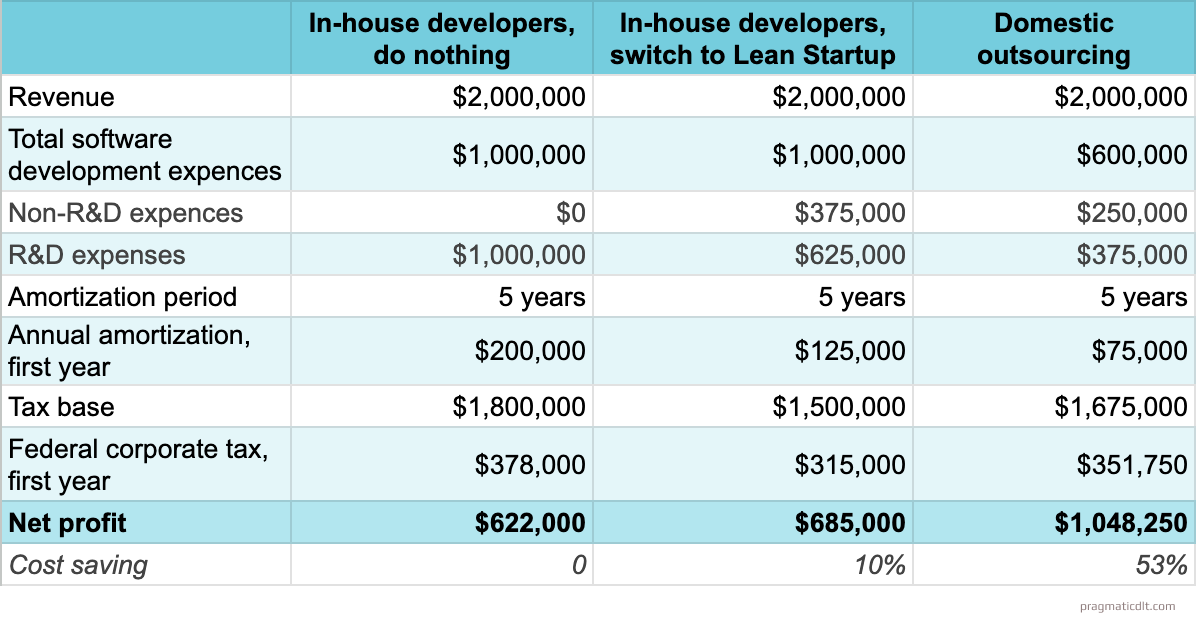

Section 174 amendments on R&D expenses are a big problem for current startups and small and medium companies. However, there are several ways to deal with this problem. Let’s explore each based on our example of ACME.com with $2m in revenue and $1m in software development costs. As discussed above, ACME’s tax obligations in the first year will increase by $128,000. Not good. We can do better.

Way 1: Lean Management approach for cost-effective R&D

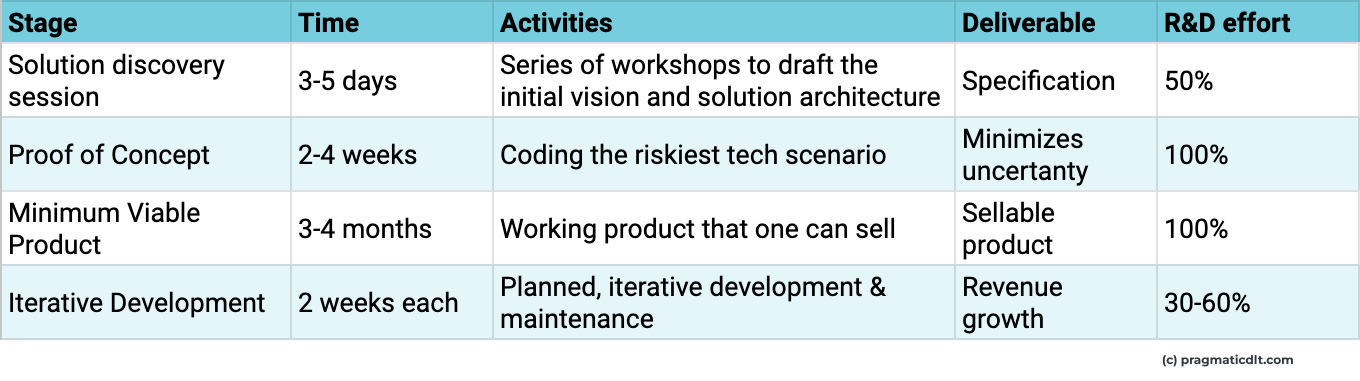

Creating an app from scratch indeed falls under research and development (R&D) activities as it involves creating a new innovative asset and a lot of uncertainty. However, we might tackle it in different ways. For instance, instead of spending years of R&D to release it live only when we think it is a perfectly polished product, we can use the Lean Startup approach.

With this approach, we’ll only focus on establishing a basic version of our product, the Minimum viable Product (MVP), with minimal investment upfront. Then we can evolve it based on the users’ feedback, our plans, and market motion. Having the app live would allow us to account for some of the software development expenses to maintenance, which is not R&D. For example, our ACME.com has $1,000,000 in R&D expenses for our new product, which we must amortize over 5 years. But now ACME.com has switched to launching a Minimum Viable Product (MVP) in the first three months.

Doing the first version of the product is indeed an R&D effort involving discovering unknowns and innovating. OK, now R&D expenditures are 3/12 of our budget, or $250,000. But wait, after we’ve launched the product – we’d need to fix bugs, do routine maintenance, add analytics, and all the other boring things that are not R&D.

We can argue now that the ratio of R&D expenditures is not ~30-70%. Which, applied to 9/12 of our total budget, makes it ~$375,000. So now our R&D expenditures are $250,000+$375,000 = $625,000! Or only 62.5% of the initial $1,000,000! Cool. Pragmatic DLT can help us launch a Minimum Viable Product (MVP), where we can minimize initial R&D costs before we know what engages our target customers. The real-world feedback helps us improve our product.

This method is not only effective, but it also guarantees that the development we invest in is directly related to the needs of our customers. By doing this, we can reduce our initial R&D costs and concentrate our further spending on improvements that aren’t usually considered R&D, while reducing R&D tax implications. Our multi-level approach includes:

By implementing this strategy, we can minimize initial R&D expenses not only on the new product launch but also by moving these processes to another company, which helps reduce costs on in-house developers.

Way 2: Domestic outsourcing

But that’s not it! Additionally, we can try outsourcing to reduce our R&D expenses. This is usually 40-60% cheaper than hiring in-house developers. The only problem would be that outsourcing, being nearshore or offshore, would require now to amortize costs over 15 and not 5 years… If only there would be a solution…Wait! There actually is!

We can outsource to a domestic company! It will allow us to amortize the costs over 5 years instead of 15 while still using all (esp the cost) the benefits of overseas outsourcing. In our example from above, our actual expense base would now be $400,000 – $600,000, amortized over 5 years, effectively slashing our annual costs in half! Pragmatic DLT can also help you with that. We are a US-based company incorporated in Delaware specializing in Lean Startup innovation. We offer you the best of both worlds – expense cuts around 50% of the in-house team while allowing you to amortize the R&D part of the expense over only 5 years!

Way 3: Creative Intellectual Property Assignment Strategies to Navigate Section 174

Some of our customers have a subsidiary company overseas (or can easily establish and control one) – and they shared the way to work around Section 174’s amends via so-called “intellectual property assignment”. Basically, the US company sells its intellectual property (IP) rights (like patents or trademarks) to an overseas company. So, how does this help? It’s simple: your US company doesn’t have an asset now, so can not be a subject of amortization requirements. While still operating, researching & developing, and earning revenue from the asset, as should be specified in that sales arrangement.

When a foreign subsidiary buys the IP rights, it should now amortize the costs of the acquired IP rights according to the host country’s laws. On the flip side, some money should be paid for these rights, which will be considered income and might be taxed in its host country. However, the U.S. company can get royalty or licensing fees from the subsidiary for using the IP.

The parent company may have some minimal costs related to legal and professional fees for the transfer of IPR, amortization if it previously recorded development costs, and some tax penalties if the sale price isn’t fair market value. These must be compared with the additional expenses you’d incur in the first years according to new Section 174 amendments.

Also, before you seriously consider this, take a good look at the tax laws of the jurisdiction where your subsidiary is placed and make sure it’s fine with the other shareholders and investors, if there are any. Please remember that this is not legal or financial advice and may have additional complications. So It’s always smart to get advice from a tax/legal professional to ensure you won’t cause any issues with this move.

Conclusion

Section 174 amendments present challenges, particularly for tech startups, early-stage companies, and small and medium-sized businesses, significantly slowing innovation processes in the United States. However, by using the workaround strategies described above and understanding the nuances of the new legislation, your business can optimize its tax liabilities and support innovation in the face of new Section 174 R&D changes. Key takeaways and future considerations:

- Understanding the law: New amendments to Section 174 R&D hurt innovation, especially for startups with limited cash reserves. Starting from January 1, 2022, businesses are forced to manage the mandatory amortization of both domestic and overseas R&D expenses over a period of 5 or 15 years;

- Changing financial landscape: The expenses that must be amortized remain unchanged; the only difference is that they must now be amortized and included in your taxable bill. However, the scenarios and duration of expenses are variable, and you can choose one that fits your business.

- Tax optimization strategies: Considering the difficulties, methods exist that minimize the effects of the Section 174 amendments. These include domestic outsourcing, lean management methods, and inversion purchase methods.

Strategies to minimize the exposure could grow net profit by up to 53%:

The tables and calculations show how the changes to Section 174 have affected companies by allocating depreciation and amortization, additional tax paid, and final net profit. Using one of the highlighted approaches that suit your needs, you can reduce your overall R&D expenses and increase net profit up to 53%. If you want to estimate the cost of MVP for your business, please contact our specialists [here].