Money matters are going through big changes. New tech and startups are mixing things up, challenging old ways of banking and finance. In this modern mashup, two key players have emerged: FinTech and TechFin. They’re closely linked yet distinct, each reshaping finance in their own unique way. One uses tech to transform financial services, while the other, brings finance to the world of tech.

Let’s dive deep, exploring what sets FinTech and TechFin apart. We’ll unpack how each is evolving the finance game and imagine what the future might hold. Buckle up for a digital finance adventure, understanding the game-changing powers at play and how they could revolutionize money matters worldwide.

What is FinTech?

FinTech, or financial technology, is all about tech companies shaking up financial products and services. From mobile payment apps to digital lending, this sector uses cutting-edge tools like blockchain and AI. FinTech trailblazers are tackling age-old money problems with innovative tech-driven solutions.

Money tech keeps growing fast. In 2018, people spent $55 billion on new money companies. More people will use these companies in the coming years. They make money stuff easier.

Money tech is good for people and companies. It helps do money things simply. People can see everything clearly. Their info is safe. Companies get new customers in new places. Money tech is also important. It lets more people use money in new ways. It helps grow the world’s economy.

Benefits and Challenges of FinTech and TechFin

FinTech and TechFin blur lines but offer unique strengths. FinTech enhances user experience and access, reshaping traditional finance and consumer expectations with its agile, innovative approach. Meanwhile, TechFin integrates financial services into broader digital ecosystems by transforming them using robust tech infrastructures. Their combined impact revolutionizes finance by exploring FinTech’s specific modern sector benefits.

Benefits of FinTech

Technology fuels financial innovation. FinTech companies create fresh methods and models enhancing user interaction. Simple services suit consumer needs best. Personalized apps empower customers efficiently.

FinTech pioneers future finance advancements. Specific advantages stand out:

- FinTech equals innovation: New tech and business models transform financial services delivery. Changes improve accessibility, convenience and processes. Blockchain secures transparent deals. AI tailors financial guidance individually. Boundaries expand with ingenuity continually.

- Customer-centric Design: User focus guides FinTech design thoroughly. Products consider the customer’s perspective fundamentally. Intuitive interfaces simplify navigation tremendously. Personalization enhances individual experiences remarkably. Streamlined procedures minimize complexity traditionally.

- Market Disruption: Technology companies change how finance works. Their affordable services make it hard for old companies. This forces those big companies to improve for customers, making finance better and cheaper overall.

- Financial Inclusion: FinTech allows more people access to money services. It doesn’t need credit checks or bank histories as much, so more folks can use things like loans and accounts. Helping more citizens handle money promotes growth in places lacking financial access.

- Agility and Flexibility: FinTech businesses can shift very quickly when markets change. If rules alter or clients want new offerings, nimble FinTechs can adapt their operations rapidly to meet demands. This agility is essential for succeeding in the ever-evolving finance world, where adjusting swiftly offers major advantages over slower companies.

New money companies really disrupted how finance used to work. Their cheaper, more efficient services pushed old companies to improve customer deals. Also, FinTech enabled access to banking for communities that didn’t have it before, promoting economic growth and inclusion in underserved areas.

Challenges of FinTech

Though innovative, FinTech faces hurdles. New laws may struggle keeping pace with unique risks and models of these firms. Balancing compliance and agility is complex.

Despite advantages, FinTech encounters obstacles:

- Regulatory Challenges: Regulations pose challenges, as innovative nature clashes with existing frameworks, making compliance intricate.

- Building Trust and Credibility: Newer companies work harder to establish trust and credibility as reliable options than traditional institutions.

- Fragmented Market: Niche services proliferation fragments market, complicating user experience managing multiple accounts across platforms.

- Cybersecurity Risks: Digital reliance heightens cybersecurity vulnerability, necessitating stringent protective measures.

- Limited Product Range: Progressive scope may not match the comprehensive offerings of traditional banks.

Trust and credibility concerns are significant. Newer FinTechs must prove reliability compared to established financial institutions. The landscape is fragmented with many niche players, potentially complicating consumer experiences navigating multiple platforms.

You might also like

business-intelligence

Investigating Cloud Application Development for Pragmatic DLT

Cloud app creation changes how we think about building, launching, and maintaining software. This change helps companies be more flexible, adaptable, and focused on data, crucial characteristics in our rapid digital world. As tech keeps progressing, top players like Pragmatic DLT use these advances to provide improved, advanced options. This tutorial makes clear the complexities […]

Distinctions Between FinTech and TechFin

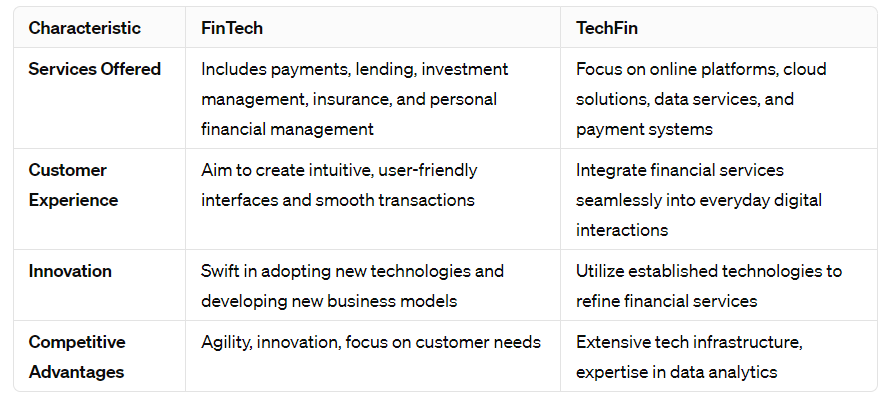

We can look at the core traits, work styles, and market forces of FinTech and TechFin firms. We will use three tables for this. This makes it easy to understand.

Foundational Attributes

FinTech startups take on old finance companies. They use new tech to solve long-standing issues and improve processes. They start with finance. Then, they add tech solutions. On the flip side, TechFin giants already have robust digital platforms. They then move into finance to boost customer experience. So FinTech goes from finance to tech, while TechFin travels the opposite path.

Operational Characteristics

FinTech firms focus on innovative, customer-friendly services like mobile payments, personal finance apps, and digital banking tools tailored to niche needs. Their agile approaches prioritize simplicity and accessibility. In contrast, TechFin companies integrate finance into existing technological ecosystems like e-commerce and social media to create seamless experiences. With massive tech infrastructure, they leverage data analytics and cloud computing to power diverse financial offerings across their platforms.

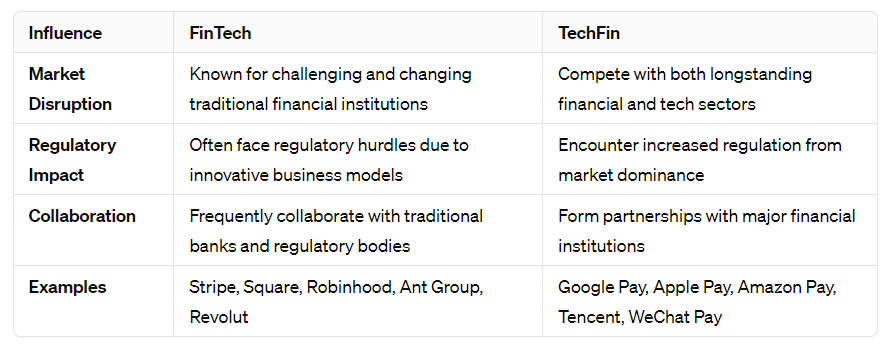

Market Influence and Collaboration of FinTech and TechFin

In the marketplace, FinTech disrupts traditional finance. It encourages competition that improves services and products for consumers. Yet, FinTech faces regulatory hurdles. Collaborating with established institutions helps navigate these challenges. TechFin, on the other hand, uses market dominance to shape financial services within tech. This often leads to more regulatory scrutiny. Both sectors seek partnerships. FinTech partners for institutional knowledge and resources. TechFin partners to merge financial expertise with technological innovation. Their goal? Develop solutions that enhance financial ecosystems and customer experience.

These three tables organize distinctions between FinTech and TechFin. They highlight how each leverages strengths and navigates the financial technology landscape.

The Evolution of Banking: Comparing the Impact of TechFin and FinTech

In banking’s evolution, FinTech and TechFin intersect. Innovative startups and tech giants reshape finance. Here’s a glimpse into likely developments shaping banking’s future, influenced by FinTech and TechFin:

- Enhanced Digital Experience: Digitalization in banking accelerates, driven by FinTech and TechFin innovations. Customers expect streamlined services across digital platforms, with customization and user-friendly designs. Digital wallets, financial management tools, and mobile banking solutions will expand.

- AI and Automation: Smart machines and technology upgrades are changing banking. Chatbots and AI helpers will answer customer questions and give support, while computer programs detect fraud, suggest investments, and improve credit scores. Robots will also simplify back-office jobs, cutting costs and errors.

- Collaboration and Open Banking: Open banking enables the sharing of data securely across different systems. This collaboration between banks, FinTech startups, and tech giants allows new financial services through partnerships and shared programming. Innovation and more options for customers are unleashed.

- Data-Driven Decision Making: Banks will use more data insights in the future to make smart decisions. AI and machine learning will analyze large amounts of data, tailoring products and services for each customer. Protecting data safety and privacy must be a top focus as banking becomes data-centric.

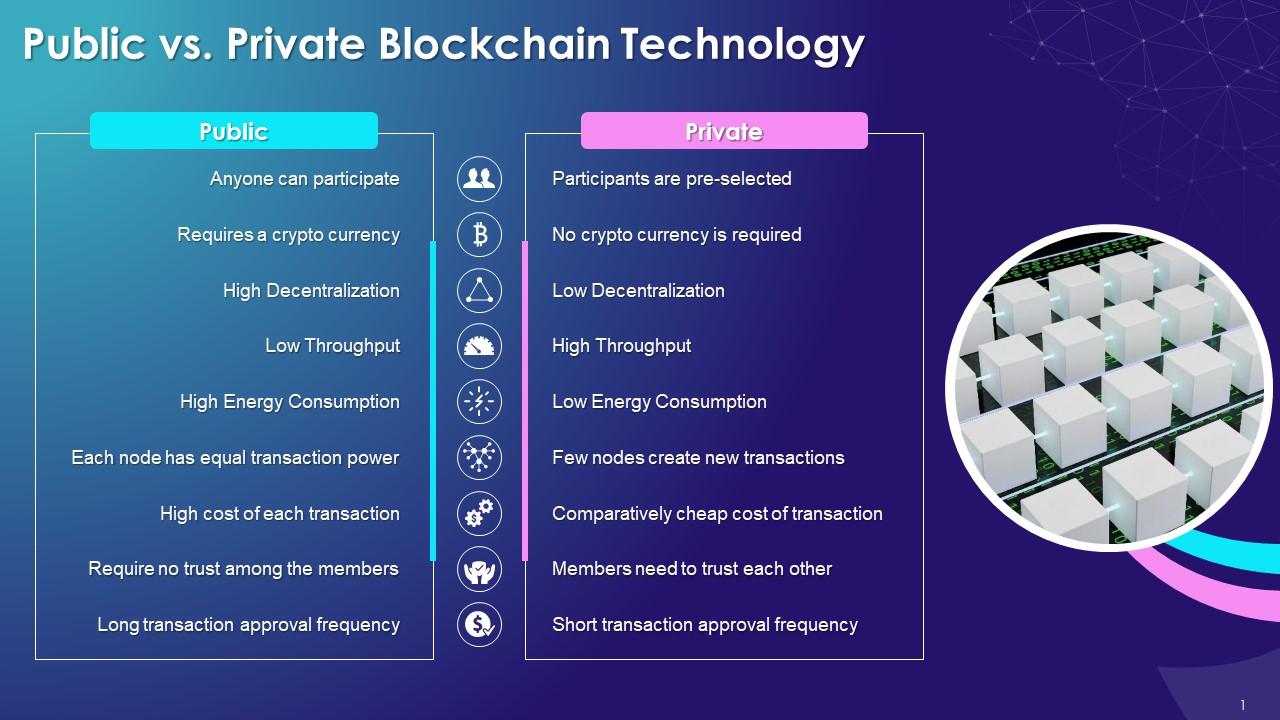

- Blockchain and Cryptocurrencies: Blockchain tech disrupts traditional banking processes by making transactions secure, transparent, and efficient. Distributed ledgers streamline trade financing, global payments, ID verification. Rise of cryptocurrencies and Central Bank Digital Currencies impacts core banking infrastructure and payment systems.

The banking world is changing. TechFin and FinTech innovations will transform it. Their collaboration enhances banking efficiency and access. It also introduces new ideas for managing money. TechFin brings cutting-edge technology, while FinTech offers creative solutions. Together, they’ll provide unmatched banking services and integration. This synergy ensures that the financial industry stays ahead with technology. Banking will become more inclusive, secure, and focused on customers’ needs. The future of banking looks promising with these advancements.

Eye-opening Examples of FinTech and TechFin Applications

FinTech and TechFin play complementary roles in reshaping finance. On the one hand, FinTech innovates with agility to enhance consumer finance interactions and solve specific challenges. Contrasting that, TechFin integrates financial services seamlessly into tech companies’ digital ecosystems using robust technological foundations. Together, they leverage technology dynamically to refine and expand financial services delivery and experience, each contributing uniquely while pursuing a unified transformative goal.

FinTech Applications

FinTech, financial technology abbreviated, drives innovation across multiple finance domains. Key areas where FinTech significantly impacts:

- Digital Payments: Transactions revolutionized by FinTech. Developing peer-to-peer payment networks, mobile wallets, embracing digital currencies. Users enjoy enhanced security, convenience. Seamless transfers, transactions across global borders without traditional banking intermediaries. Financial exchanges faster, more accessible.

- Online Lending: Transforming lending, FinTech links borrowers and lenders online. Advanced algorithms assess credit quickly, factoring untraditional data and democratizing capital access. Even those disqualified conventionally gain loan opportunities.

- Robo-Advisory: Robo-advisors automate investment counsel using algorithms, reducing human advisors’ involvement. Surveying clients’ finances and goals, these services manage portfolios automatically, lowering costs significantly.

- InsurTech: Streamlining insurance, InsurTech leverages tech. Claims are processed automatically, expediting settlements. Personalized policies, tailored individually using data insights, enhance customer experience.

- Personal Finance Management: Money tools from FinTech firms help individuals manage their finances better. Users can see where their money goes, make budgets, and get advice to improve habits. Personalized tips assist in reaching goals like saving or paying off debts.

These programs go beyond just enhancing existing financial services – they bring new capabilities. This expands how many people can control their money. These innovations challenge how finance has been done before, bringing flexibility and fostering an open environment in FinTech.

Use Cases for TechFin

TechFin refers to tech companies entering the finance industry, leveraging their large user bases to seamlessly incorporate financial services into digital platforms. This integration creates a comprehensive experience where financial activities blend into users’ everyday digital tasks. Let’s review some specific examples of TechFin driving significant changes:

- Digital Wallets: Digital Wallets make sending money easy. Pay bills, shop online, and transfer cash worldwide – all through apps used daily. TechFin connects apps and tech systems to facilitate smooth money movement.

- E-commerce Integration transforms online shopping: Pay, get financing, “buy now, pay later” – without leaving the website. Users enjoy smoother purchasing. Businesses boost sales and streamline operations.

- Solid cloud infrastructure: Robust cloud infrastructure powers secure, scalable financial services like payments, risk checks, and transaction tracking at TechFin firms. This cuts costs for institutions and enhances offerings from new players.

- Valuable data analytics capabilities: TechFin companies analyze user data to understand spending habits, behaviors, and market trends. They use advanced analytics to gain insights from this data. These insights help personalize products, target marketing and risk management, and customize offerings for different customer groups.

- Open banking promotes innovation: Open banking promotes innovation in fintech. TechFin companies use APIs, allowing outside developers to build apps around banks. Secure data sharing enables data to flow across platforms. This fosters new service possibilities. Supporting open banking connects the financial world. Collaboration and data sharing lead to innovative solutions.

With practical examples, tech-based finance firms do more than expand traditional finance services. They open new paths for technology to transform the financial world, making it more integrated, efficient, and easy to use.

Conclusion

The FinTech and TechFin sectors are closely linked, though distinct. Both offer digital tools that change how we manage finances, from transactions to investments. FinTech aims to enhance personal finances through apps that make transactions and planning effortless. TechFin, on the other hand, uses robust tech platforms to grow financial services, providing seamless integration and superior user experience. As these sectors continue to grow, they both challenge and support each other, driving the digital money transformation.

Choosing between FinTech and TechFin requires careful thought about wants and goals. Both offer different opportunities and challenges but can greatly impact how businesses and users deal with financial systems. For those in this changing field, knowing critical skills and possible uses of FinTech and TechFin is vital. Combining tech skills with financial knowledge is key to using these advancements for business aims and pushing the boundaries of modern finance.