In the dynamic landscape of banking industry, the push for digital transformation presents a unique set of challenges. At this critical point in the industry, adopting technological innovations has become essential, not just a choice, for maintaining a competitive edge. However, this journey is riddled with obstacles, from integrating cutting-edge technologies to aligning them with existing legacy systems and ensuring they meet stringent regulatory standards. This guide is crafted to provide industry leaders with expert insights aiming to navigate the complex terrain of digital transformation in banking. Here, we delve into strategic approaches and practical solutions designed to surmount common barriers, setting a course toward a successful digital future for banks.

Unraveling Digital Transformation in the Banking Sector

The banking industry is currently undergoing a significant metamorphosis, with institutions of all sizes eagerly embracing an array of new technologies and services. What exactly defines the essence of digital transformation within the banking sector? At its core, it signifies a profound shift towards increasing online and digital services, alongside extensive backend modifications to facilitate this evolution.

A common pitfall for many banks is embarking on disparate digital initiatives without adequate support or cohesion, resulting in an inability to match the prowess of digital-native entities. To circumvent this, digital transformation within the banking sector necessitates a comprehensive, top-down strategy that seamlessly integrates digital systems, customer experience platforms, applications, and underlying infrastructure.

Examples of Digital Transformation in Banking

In banking, digital transformation signifies a comprehensive overhaul, aiming to introduce online services and embed technology deeply within the bank’s operational fabric. This transformation encompasses a broad spectrum of technological advancements and strategic implementations designed to elevate both the customer experience and the bank’s efficiency. Let’s explore some of the most impactful examples of digital transformation within the banking sector.

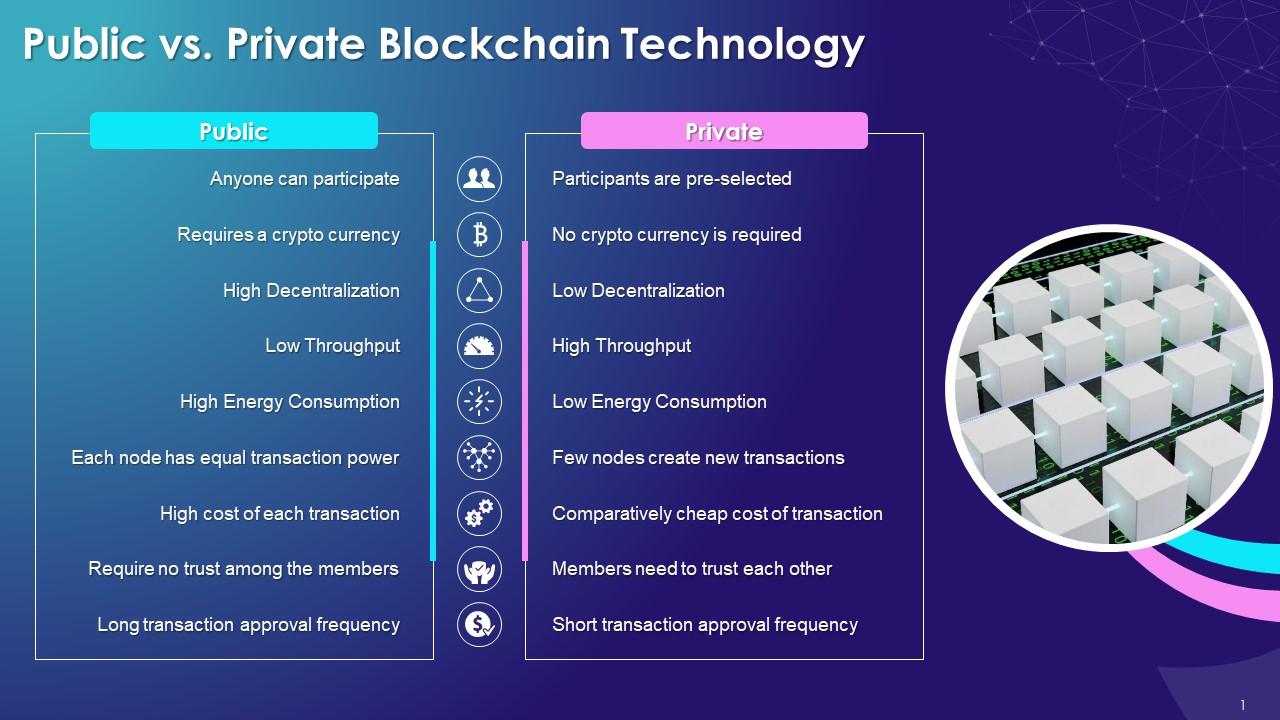

Implementing Blockchain Technology

Blockchain technology has risen as a fundamental pillar in the banking sector’s digital overhaul, transforming the methods of transaction processing and record-keeping. Through its decentralized and secure ledger system, it provides unmatched levels of security, transparency, and operational efficiency. Its applications range from simplifying cross-border payments to enhancing the integrity of transaction records, ultimately reducing fraud and operational costs.

Utilizing Artificial Intelligence (AI)

Artificial Intelligence (AI) stands at the forefront of the banking sector’s digital evolution, driving significant enhancements in customer service and operational efficiency. AI-driven chatbots and virtual assistants offer continuous customer service, efficiently and accurately managing questions and transactions at any time. Beyond customer interaction, AI algorithms offer deep insights into customer behavior, enabling personalized banking experiences and aiding in developing tailored financial products.

Advancing Customer Data Collection, Management & Analysis

The digital era has endowed banks with the capability to collect and analyze vast amounts of customer data, a practice that is fundamental to understanding and anticipating customer needs. Through sophisticated data management and analysis tools, banks can now unlock actionable insights, predict customer behavior, and identify trends. This not only aids in customizing banking services but also enhances decision-making in product development, risk management, and strategic planning.

These instances highlight the complex and varied dimensions of digital transformation within the banking industry. The adoption of cutting-edge technologies like blockchain and AI, coupled with advanced data analytics, propels banks towards a more efficient, secure, and customer-centric future. As banks navigate their digital transformation journey, these technological tenets serve as guiding lights, illuminating the path to innovation and sustained growth.

Exploring the Key Facets of Successful Banking Transformation

Transformations in banking are not merely about technology upgrades; they’re a comprehensive reevaluation of how a bank operates, engages with its customers, and innovates. This discussion delves into the strategic underpinnings that make these transformative endeavors fruitful.

Visionary Leadership and Purpose-Driven Transformation

Visionary leadership coupled with a purpose-driven strategy is the bedrock of any successful transformation. Leadership must articulate a compelling vision that transcends mere financial gains, aiming to revolutionize customer experiences, streamline operations, and foster a culture of innovation and agility. This vision serves as the beacon, inspiring and directing the entire organization towards a shared objective. The leadership must instill a sense of purpose and excitement about the transformation, ensuring that this enthusiasm permeates all levels of the organization.

Cultivating a Culture of Engagement and Ownership

For a transformation to take root, it must become everyone’s business within the organization. This entails fostering an environment in which each team member feels a deep personal stake in the success of the transformation. It’s about moving beyond the confines of traditional roles and hierarchies, encouraging cross-functional collaboration, and fostering an environment where feedback and ideas are freely shared. Regularly communicating the ‘why’ behind the transformation, celebrating milestones, and openly addressing challenges can help sustain momentum and build a sense of collective ownership.

Agile Operating Models and Continuous Innovation

Adopting agile operating models is crucial for banks to navigate the complexities of digital transformation. This means moving away from siloed, project-based approaches and embracing more fluid, iterative processes that allow continuous testing, learning, and adaptation. An agile mindset encourages experimentation, accepts failure as a step towards innovation, and promotes a culture of constant improvement. It’s about creating an organizational rhythm that aligns with the dynamic nature of the digital world, ensuring that the bank can swiftly respond to emerging trends, technologies, and customer needs.

Strategic Design and Robust Governance

Successful banking transformations are underpinned by strategic design and robust governance structures. This entails a holistic approach to technology architecture, ensuring it is scalable, flexible, and capable of supporting the bank’s long-term objectives. Design principles should guide the selection of technologies, integration of digital platforms, and the overall customer experience strategy. Concurrently, effective governance is essential to navigate the transformation’s complexity, manage risks, and ensure alignment with regulatory requirements. Governance frameworks should facilitate swift decision-making, encourage accountability, and enable transparent organizational communication.

Leveraging Data and Analytics for Insight-Driven Transformation

Utilizing analytics and insights stands as a significant catalyst for banking transformation. Making decisions based on data can shed light on customer habits, desires, and challenges, steering the creation of customized services and groundbreaking products.Furthermore, analytics can optimize operational efficiencies, identify new market opportunities, and enhance risk management. Establishing robust data management practices and investing in advanced analytics capabilities are critical for banks to harness the full potential of their data assets and drive successful transformation.

You might also like

business-intelligence

Mastering IoT Device Control: Remote and Local Management Techniques

The Internet of Things (IoT) has revolutionized daily life with smart devices, enabling remote control and real-time management. IoT device control involves provisioning, authentication, configuration, and monitoring. Diverse interaction modalities including mobile apps, voice control, web interfaces, and remote protocols offer flexibility. Selecting the right IoT device management platform and mastering control require careful planning and setup for security, integration, and automation.

Revolutionizing the Customer Experience through Digital Integration

The digital transformation journey within the banking sector is revolutionizing how customers interact with financial services, moving away from the traditional, segmented approach towards a more integrated and personalized experience. At the heart of this transformation is creating a unified digital platform where all banking processes are consolidated. This strategic shift streamlines operations and ensures consistency in customer service, providing a seamless journey from lead generation to after-sales support. Banks can offer a more coherent and efficient experience by centralizing services, reducing operational redundancies and enhancing customer satisfaction.

Cross-functional collaboration is essential to this new digital ecosystem, as it brings together technical and customer-facing teams to foster innovation and responsiveness to customer needs. The integration of technical personnel with sales and marketing teams breaks down silos and creates a more agile and customer-focused approach. This synergy ensures that technological advancements align with the customer’s journey, ensuring that digital solutions are practical and tailored to enhance the customer experience.

The digital pathway crafted for customers encapsulates a frictionless journey through all banking interactions, from initial engagement and account setup to service utilization and transaction completion. Automation and digital functionalities are key to this process, offering convenience and accessibility that meet the modern consumer’s expectations. These technologies expedite service delivery and improve operational efficiency, allowing banks to allocate resources toward strategic initiatives to build deeper customer relationships.

The shift towards a digitally integrated banking experience reshapes the customer journey into a more streamlined, efficient, and personalized process. This digital transformation is not just about technological upgrades but represents a fundamental change in how banks engage with their customers. By leveraging digital platforms, fostering cross-departmental collaboration, and embracing automation, banks can offer services that align with today’s digital-first consumer, paving the way for increased customer loyalty and long-term success in the digital age.

Opportunities for Industry Leaders

The banking sector’s digital transformation opens many opportunities for industry leaders. These opportunities pave the way for enhanced operational efficiencies and customer experiences and create avenues for new revenue streams and competitive differentiation. Let’s delve into these opportunities in more detail.

Enhanced Customer Experience

Digital transformation allows banks to revolutionize how they interact with their customers. By harnessing the power of technologies such as artificial intelligence (AI), machine learning (ML), and data analytics, banks are able to deliver banking experiences tailored to the unique needs of each customer. For instance, AI-driven chatbots can offer:

- 24/7 customer service.

- Answering queries and solving problems in real-time.

- Thus increasing customer satisfaction and loyalty.

Additionally, digital platforms facilitate smooth banking interactions across various channels, guaranteeing ease of use and access for every customer. This focus on customer experience attracts new and retains existing customers, creating a solid base of loyal clients.

Operational Efficiency

Automation and digital processes are critical components of digital transformation that significantly contribute to operational efficiency. By automating mundane tasks like data input, transaction management, and regulatory compliance, banks can significantly cut down on the time and resources expended on these operations. This reduction in operational expenses and diminished risk of human mistakes leads to more precise and dependable services. Digital processes also enable banks to streamline their workflows and operations, allowing quicker decision-making and more efficient service delivery. These improvements in operational efficiency can lead to substantial cost savings and higher productivity levels across the organization.

New Revenue Streams

Digital banking platforms pave the way for the introduction of creative products and services that respond to the changing demands of customers. For example, through the analysis of customer data, banks can uncover needs that have yet to be addressed and create personalized financial solutions, including bespoke loan options, investment possibilities, and insurance offerings. Digital platforms also enable the integration of non-traditional banking services, such as e-commerce, digital wallets, and financial management tools, offering customers a more comprehensive financial ecosystem. These new products and services generate additional revenue streams and enhance customer engagement and satisfaction.

Competitive Advantage

Innovation in digital banking serves as a key differentiator in a crowded market, providing banks with a competitive edge. Banks that are early adopters of emerging technologies and digital practices can set new industry standards, positioning themselves as leaders in the digital banking space. This innovation-driven approach attracts tech-savvy customers and establishes the bank as a forward-thinking institution. Moreover, quickly adapting to market changes and customer expectations allows these banks to stay ahead of the competition, securing their market position and ensuring long-term success.

Harnessing Data for Strategic Insight and Personalization

Accumulating data from various digital touchpoints offers an unprecedented opportunity for banks to refine and enhance their operational strategies, customer service frameworks, and overall strategic direction. This vast repository of data, gathered from customer interactions across digital platforms, serves as the foundation for a more analytical approach to banking. Through sophisticated data analytics, financial institutions can delve deep into customer behavior and preferences, enabling the development of targeted marketing campaigns, bespoke educational materials, and forward-looking banking services tailored to individual needs.

The role of big data and analytics in banking extends beyond mere improvements in operational efficiency; it is instrumental in crafting highly personalized customer experiences. By analyzing the rich data at their disposal, banks can offer customized solutions that speak directly to each customer’s unique requirements. This capability to personalize extends from tailored financial offers to anticipatory service recommendations and even automated solutions that streamline the banking experience, significantly enhancing customer engagement and satisfaction.

Moreover, the strategic use of big data allows banks to stay ahead of the curve, anticipating customer needs and responding with relevant solutions before they’re explicitly requested. This forward-thinking strategy showcases a profound comprehension of what customers anticipate and solidifies the bank’s dedication to offering services that are both value-oriented and centered around the customer’s needs.The result is a more loyal customer base that appreciates the personalized attention and tailored solutions that make their banking experience more intuitive and satisfying.

Harnessing the power of data analytics and big data is critical for banks aiming to thrive in the digital age. This data-driven strategy enables financial institutions to refine their services, offering personalized and predictive solutions that resonate with their customers. By prioritizing data analytics, banks can elevate their customer service, foster deeper customer loyalty, and set a new standard for personalization in the banking industry, ultimately securing a competitive edge in the rapidly evolving digital marketplace.

Embracing Change and Innovation

Banks are confronted with the imperative need to remain flexible and responsive to the shifts in market dynamics, technological breakthroughs, and the changing demands of consumers. Often burdened by regulatory frameworks and outdated legacy systems, traditional banking entities find themselves at a crossroads, needing to transition towards more agile and innovative operational models. This shift towards agility is not just about the superficial adoption of new technologies but signifies a deeper, more foundational move towards a culture prioritizing digital-first strategies and practices.

The journey towards such a transformative digital culture demands a significant reevaluation and departure from entrenched institutional frameworks. It calls for embracing digital innovations that can redefine the essence of banking operations and customer interactions. Technologies like artificial intelligence (AI), blockchain, and various automated services stand at the forefront of this revolution, offering pathways to streamline processes and significantly uplift the customer service experience. For instance, the integration of AI-powered tools like J.P. Morgan Chase’s COIN for loan processing automation illustrates the potential of these technologies to merge operational efficiency with a heightened level of customer engagement.

Moreover, embracing change and innovation is not solely about enhancing internal efficiencies or customer experiences. It represents a strategic imperative to sustain relevance and competitiveness in a banking sector that digital-native fintech companies are increasingly reshaping. These entities, unburdened by the legacy systems that traditional banks grapple with, are setting new standards for convenience, speed, and personalization in financial services. Thus, for established banks, adopting cutting-edge technologies and cultivating a digital-first organizational culture are critical steps in ensuring they remain at the vanguard of the financial services industry.

Conclusion

The digital transformation within the banking sector represents a comprehensive shift towards creating a banking experience that is more cohesive, tailored to individual needs, and efficient in its operations. This transformative journey involves integrating digital processes, strategically utilizing data to garner insights and enable personalization, and cultivating a corporate culture that values adaptability and continuous innovation. Such an approach allows financial institutions to maneuver through the intricacies of the digital environment adeptly, ensuring they stay abreast of consumer expectations and technological advancements. While the path to digital transformation may present its set of challenges, it is a critical endeavor for banks aiming to secure their competitive edge and remain attuned to the preferences of today’s digital-savvy customers.

In essence, the push towards digital transformation in banking is not just about adopting new technologies but about reimagining the banking journey from the ground up to be more customer-centric and efficient. By embracing digital innovations, leveraging the power of data analytics, and promoting a culture that is flexible and open to change, banks can effectively respond to and even anticipate the digital consumer’s needs. This proactive stance towards transformation is indispensable for banks that aspire to survive and thrive in the digital age, offering services that align with the expectations of a rapidly evolving market and thereby fostering long-term customer loyalty and growth.